Articles

My Biggest Money Mistakes

I’ve talked before about how CPAs and financial planners are not perfect with money. And I’ve made plenty of mistakes in my lifetime but I wanted to highlight two in particular because they can be applicable to all business owners really and even to some that don’t own a business. The first of my personal

How Would You Live With No Income?

What would you do if you were unable to work? What would this look like? You have no income. What would that be to your family? How would you pay your bills? How would you keep your business running if you’re owning a business? What would this look like for you? For most people, it’d

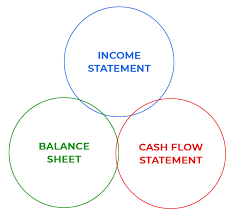

Know Your Numbers To Know Your Business

Know your numbers to know your business. We say that all the time around here. Obviously I run a financial planning firm, CWOs for Hire. We also have a CPA firm, CPAs for Hire. And if you go to that website, http://www.cpasforhire.com, you will see right there on the front page, know your numbers to

CPAs and Financial Planners are Not Perfect

Hey, guess what? Accountants and financial planners are not perfect with their money. I want to dispel one myth that is out there. If you believe that accountants, CPAs, financial planners, if you think that they are all perfect with their money, you are mistaken. We are human. We make mistakes, and we’re no different

Doctor’s Office Fails to Check Blood Pressure

There are some things that should be standard procedure. Today, let’s start with a story. I want you to imagine Paul and Mary. They’re a married couple and have a few kids. One day Paul says to Mary, “I’ve got this pain in my side. I can’t figure out what it is. It just won’t

1099 Filing Requirements for Business Owners

Let’s talk today about Form 1099s and what business owners must do to stay in compliance. Every year, business owners have to send out Form 1099s to any vendor that they pay $600 or more for services. It’s an annual requirement, the forms are due by January 31st. There are a couple of exceptions to

No Tax Now and Tax Free Later with HSAs

Let’s talk about health savings accounts. We’ll talk about what they are, and how they can provide some big tax benefits for you. So health savings accounts are often kinda confusing and can get confused with FSA accounts, which is a completely different animal. FSA stands for flexible spending account. And those accounts, it’s a

Stop Crying about Capital Gains – Donate Instead

Let’s talk about how you can avoid paying capital gains tax by donating to charity. What happens oftentimes is that if somebody has a stock that’s gone up in value over time they might say, okay let’s sell that stock and give some money to charity. It’s always good to give money to charity. Give

Are You Shoveling Buckets of Money to the IRS?

Let’s talk about how you can save a ton in taxes, if you are running a successful service business. Now, by service business, we’re talking about anything, any business that does not produce a thing. So, if your thinking about a consultant, lawyer, dentist, doctor, personal trainer or accountant. Those are all considered qualified service

Health Savings Accounts

Hi. This is Dave Zaegel. Let’s talk about health savings accounts. We’ll talk about what they are and how they can really benefit you if you’re able to use them. We’ll also contrast them with IRA accounts. We’ll show you a comparison to see how they match up with retirement savings because you can actually

Monte Carlo Simulation

Hi, this is Dave Zaegel. Let’s talk about Monte Carlo Simulations. You may be wondering what in the world is a Monte Carlo Simulation? What does it have to do with anything business or finance related? Well, Monte Carlo Simulations sounds fancy, and in some ways it is, but really when you break it down

Roth IRA Conversions

Hi this is Dave Zaegel. Today, let’s talk about Roth IRA conversions and how they can be tremendously beneficial to you for long-term planning. First, what the heck’s a Roth IRA conversion? Most people have no idea what I’m even talking about when I say Roth IRA conversion. What it is, is taking money from